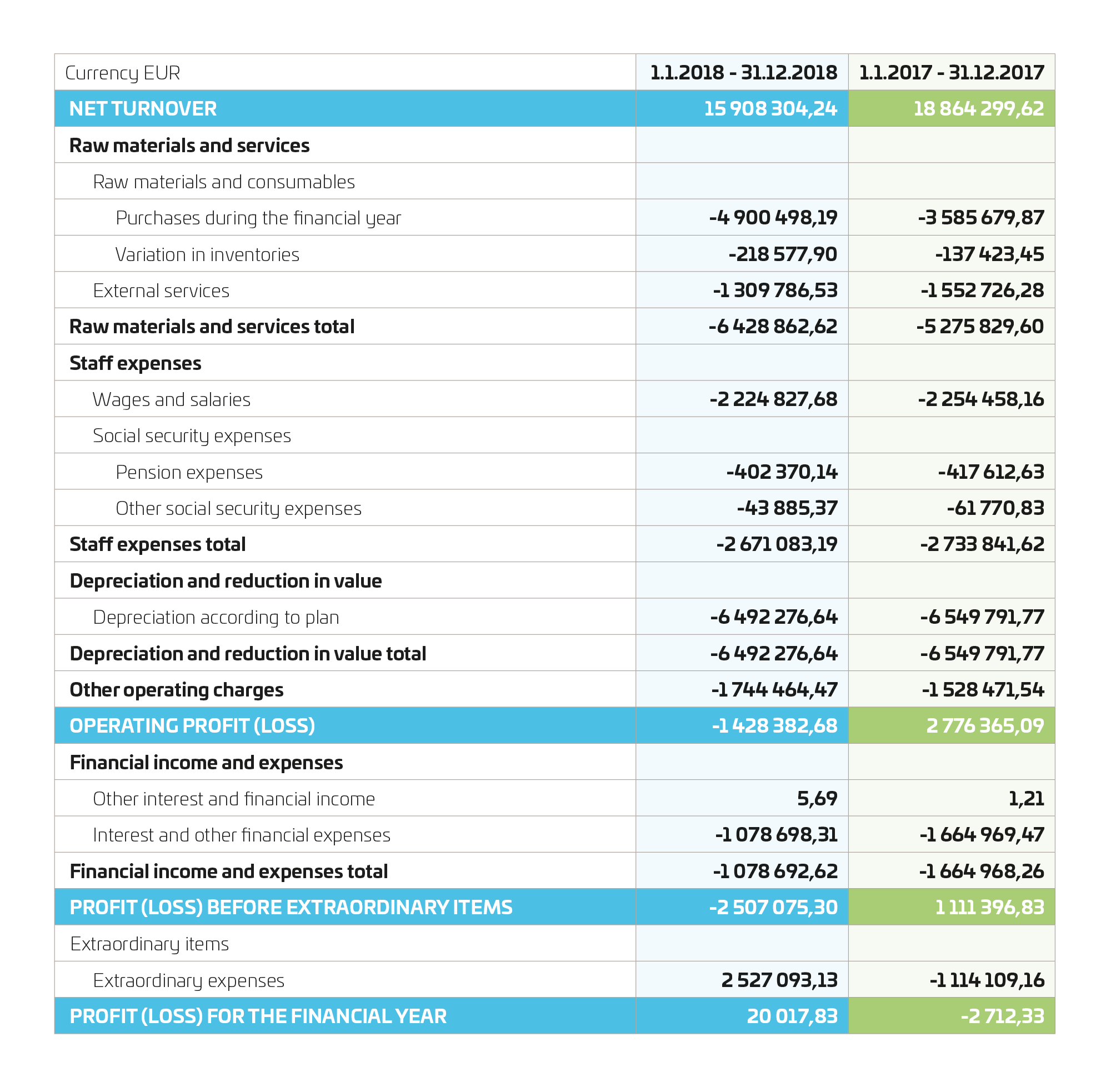

The year 2018 was an operational success for Westenergy. This is reflected, for example, in the new record of the amount of waste and very high availability of the plant. The company’s turnover in 2018 amounted to EUR 15,908,304. The company’s most important sources of revenue are waste incineration services to the shareholders and the steam energy to Vaasan Sähkö Oy, for which Westenergy Oy Ab is paid on the basis of the supplied district heat and electricity. The price of electricity was a pleasant surprise in 2018. The high availability translated also in the reliability of district heat supply. In addition, the company received significant revenue from the sales of metals separated from the bottom slag. Turnover fell from the previous year, which is explained primarily with the low price level of waste incineration services.

| Year |

2018 |

2017 |

2016 |

2015 |

2014 |

| Turnover, MEUR |

15.9 |

18.9 |

16.8 |

18.3 |

17.4 |

| Amount of burned waste, tonnes |

190,679 |

188,208 |

163,118 |

168,355 |

178,003 |

| Utilisation rate, % |

95.5 |

94.9 |

82.1 |

85.1 |

89.8 |

The delivery amount of waste was slightly lower than previous years because the stored waste was burned off over the past year. Consumption of chemicals remained moderate and the tendering procedure for chemicals that was completed in the end of the previous year began to have visible results only during the past year. A record amount of bottom slag was treated in the past year, over 50,000 tonnes. The sales of metals separated from slag amounted to a significant revenue. The costs of treating slag were increased by the so-called final disposal costs, which however are considerably lower than the opportunity cost of disposal in a landfill. The new Government Decree on the Recovery of Certain Wastes in Earth Construction made the final disposal of mineral fraction possible. The work we have done together with our partners Lakeuden Etappi Oy and Suomen Erityisjäte Oy in developing the processing of slag further has taken steps forward.

The maintenance costs were slightly above the estimate, primarily for the comprehensive maintenance during the shutdown. During the shutdown, the waste hopper was replaced, for example. During the year, also the first large revision maintenance of the turbine was made in collaboration with Vaasan Sähkö Oy. The revision maintenance restricted the production of electricity for more than a month.

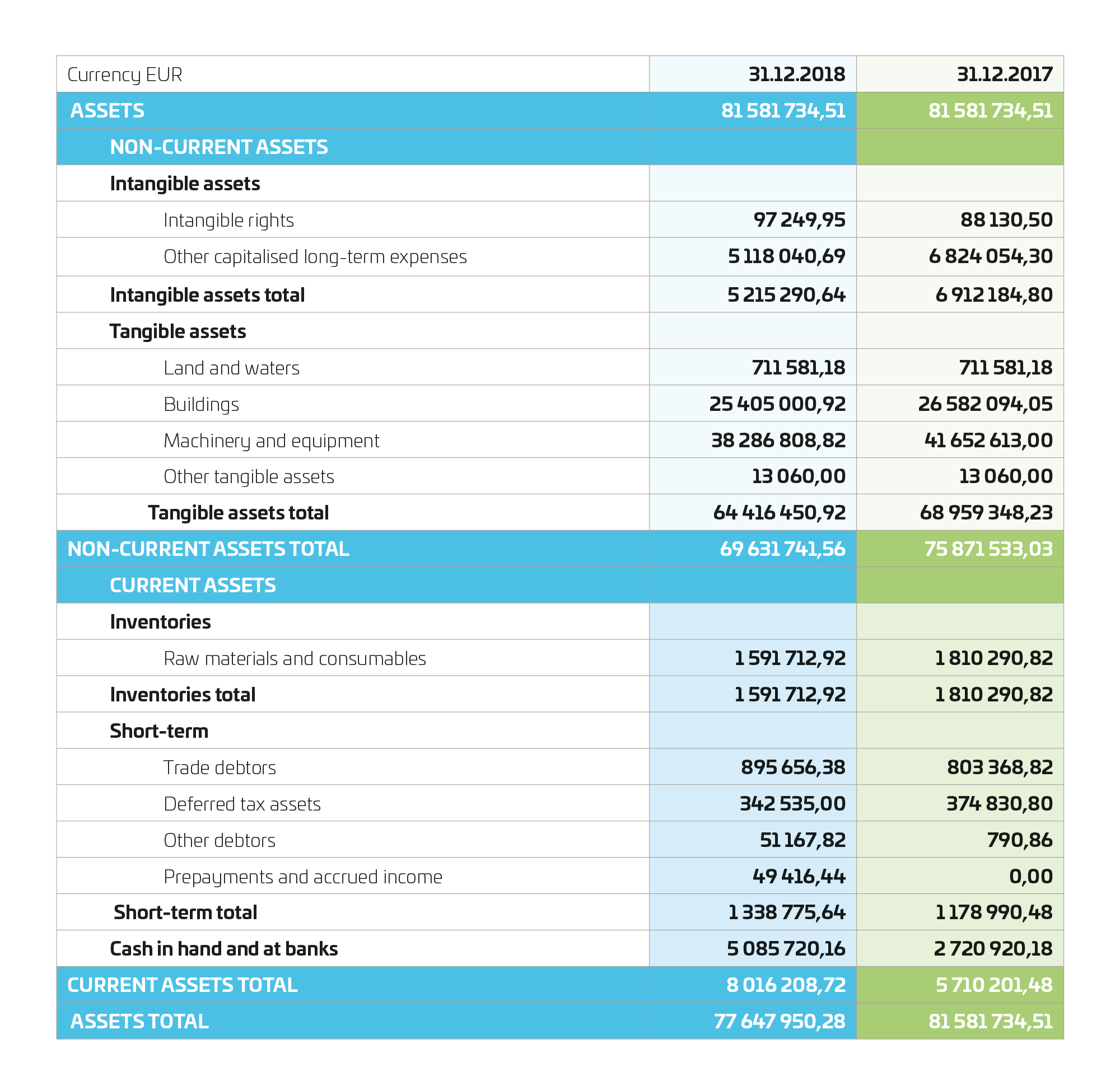

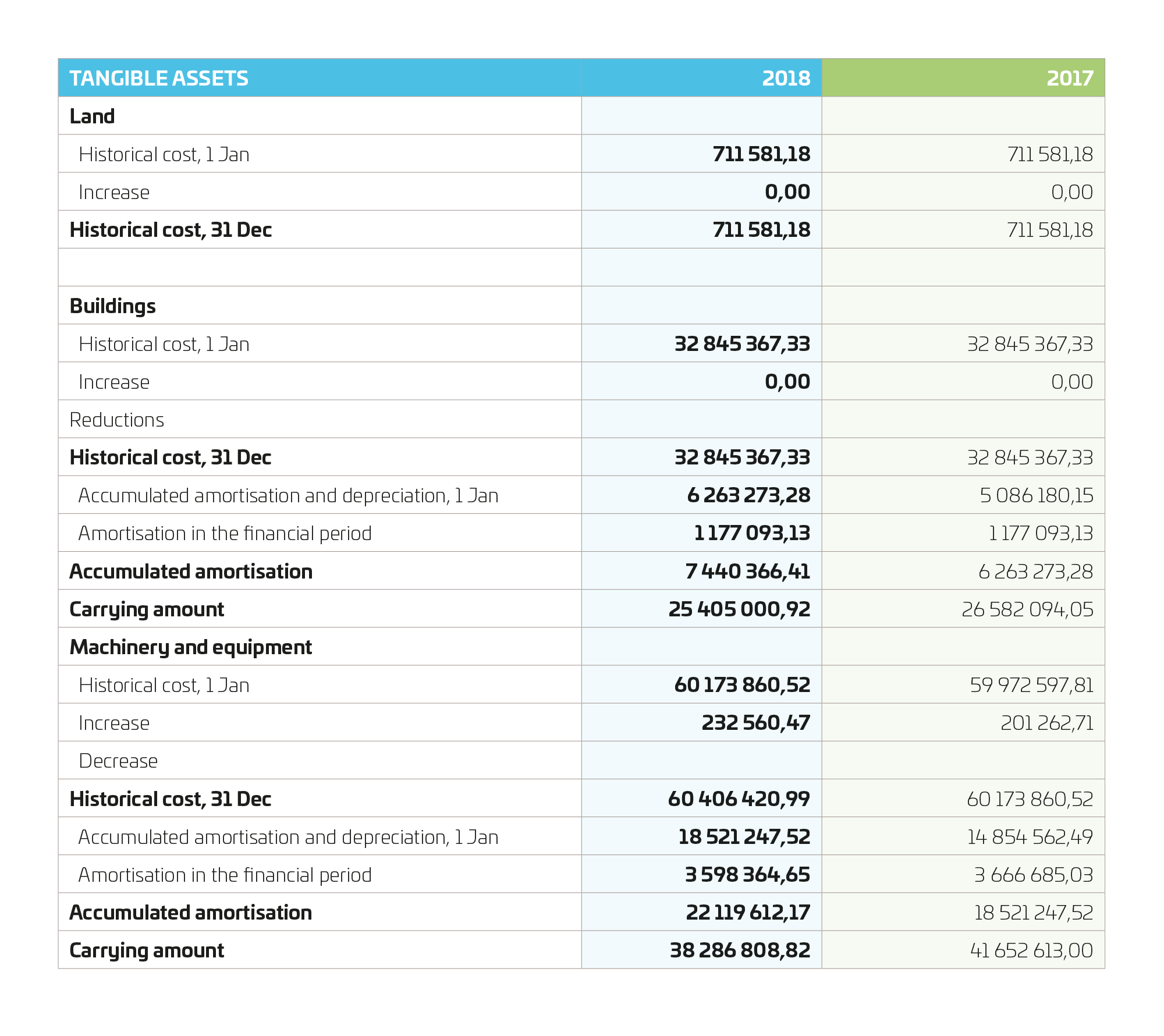

Investments in the financial period were related to the renewal of the operating system’s data collection server and emissions reporting system, improved efficiency of the lime silo’s unloading system and optimisation of the lime feeding, change of the reduction valve and new announcement system. Investments in 2018 totalled EUR 252,485.

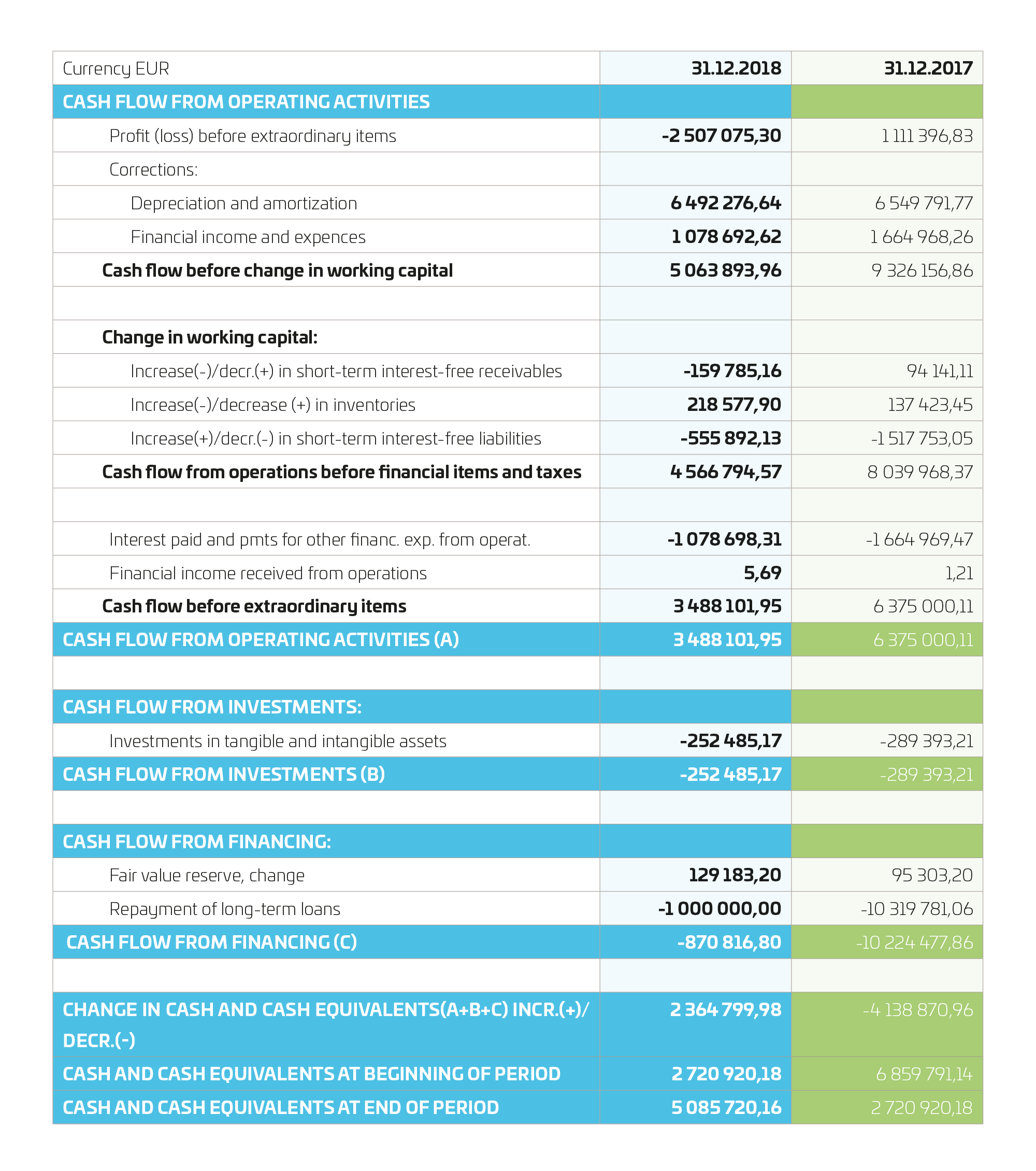

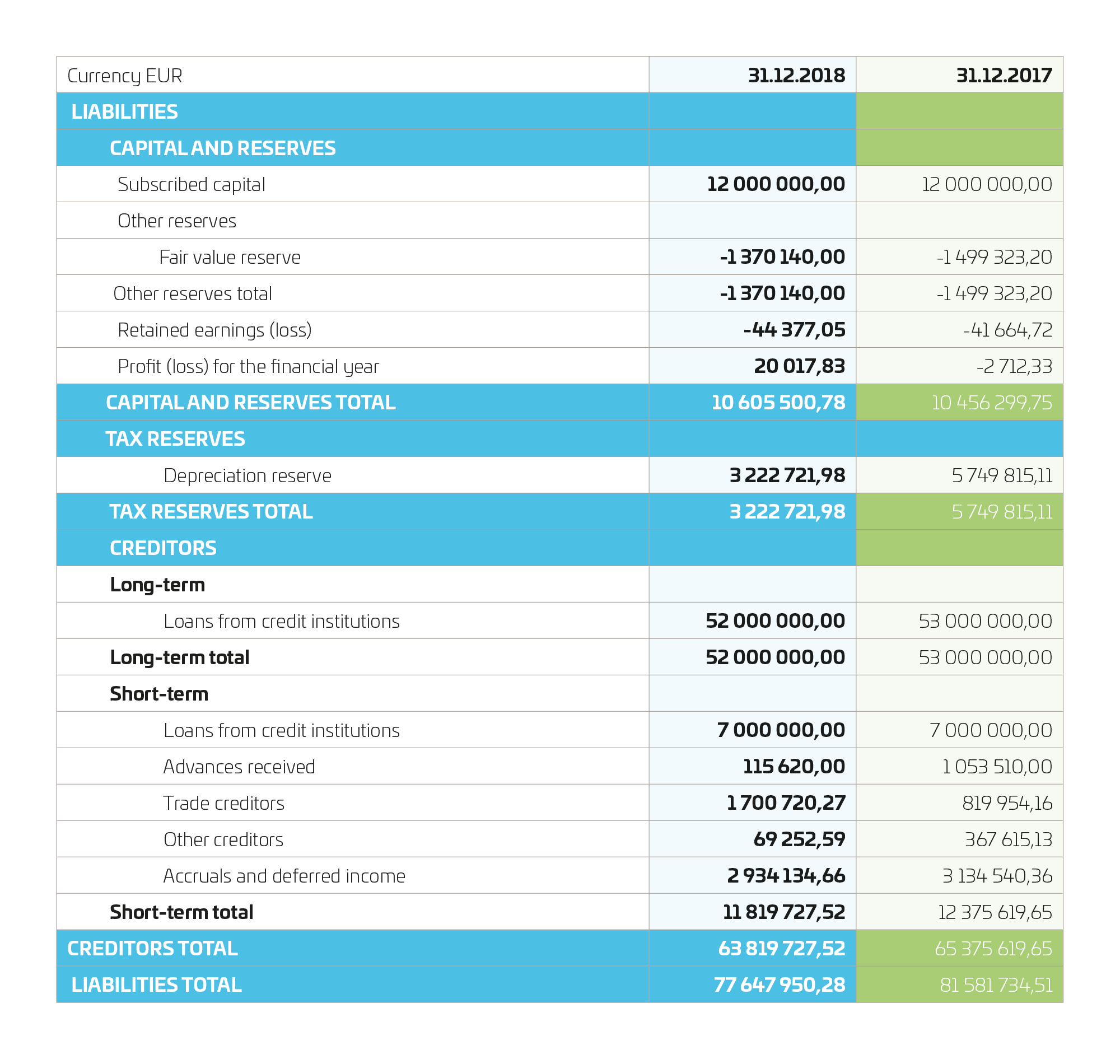

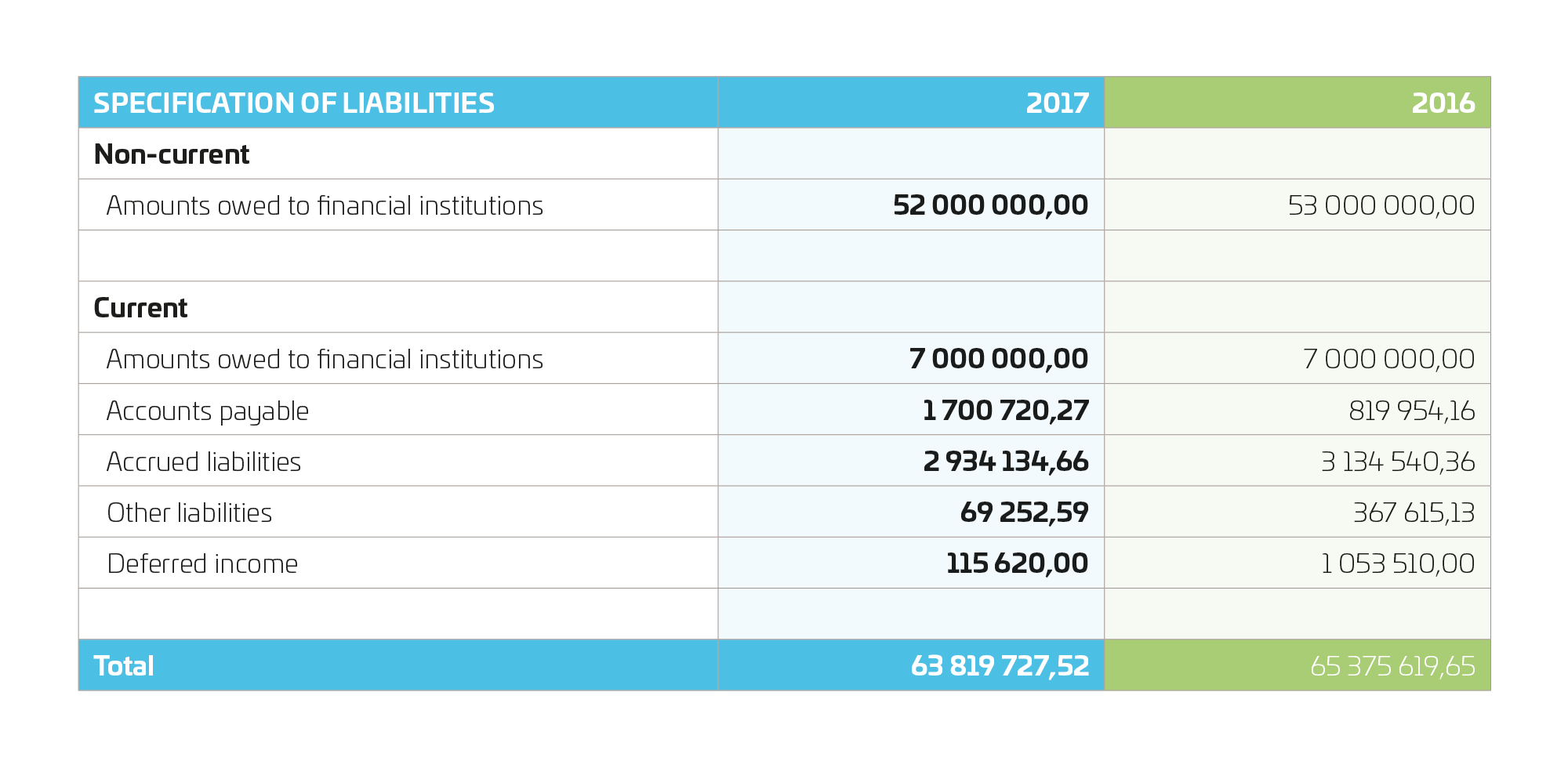

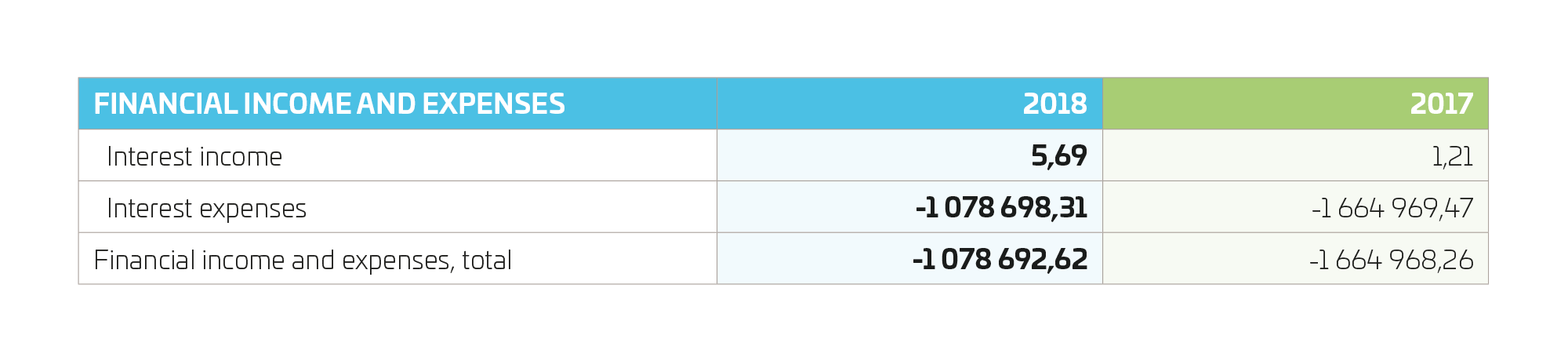

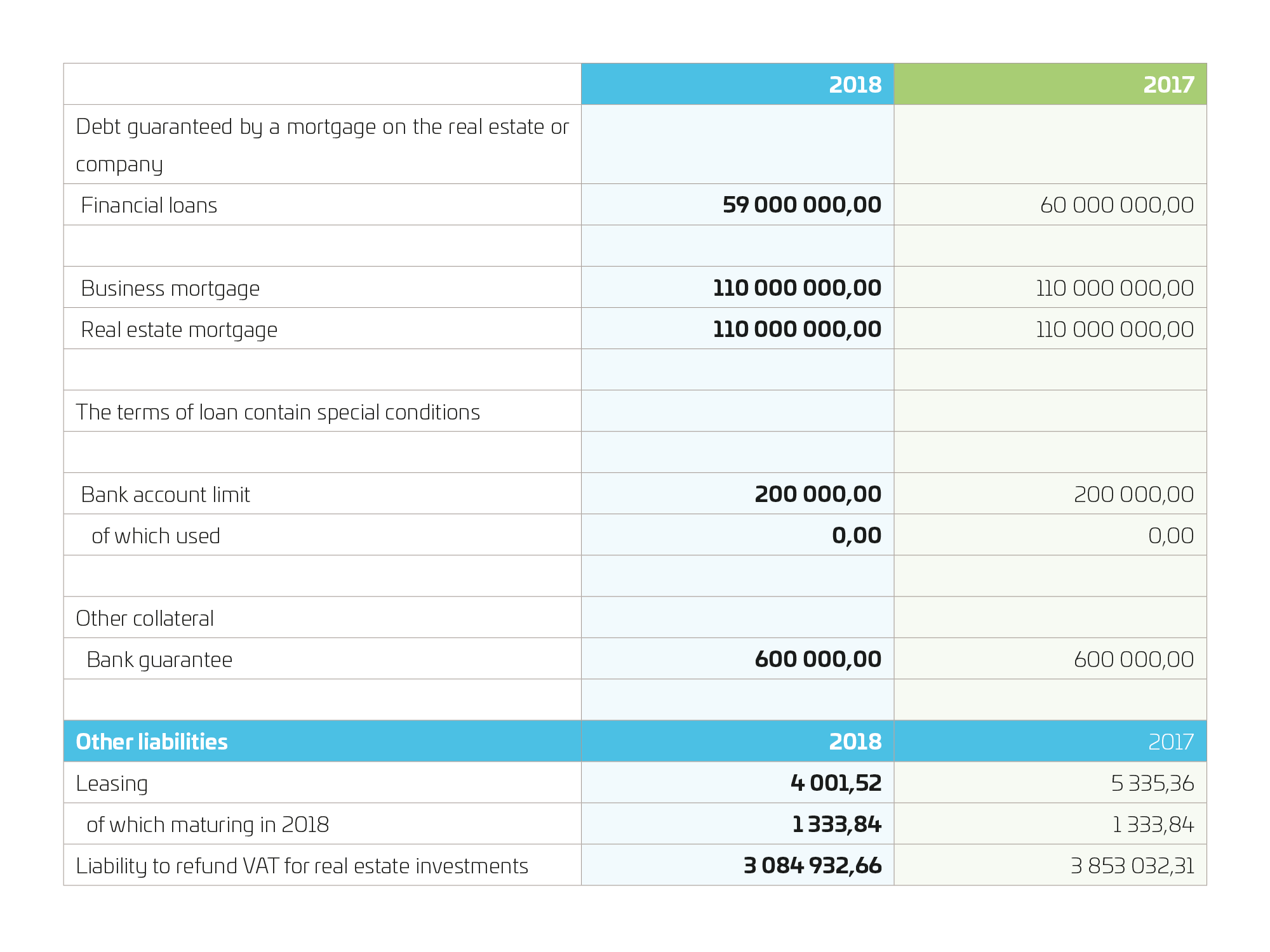

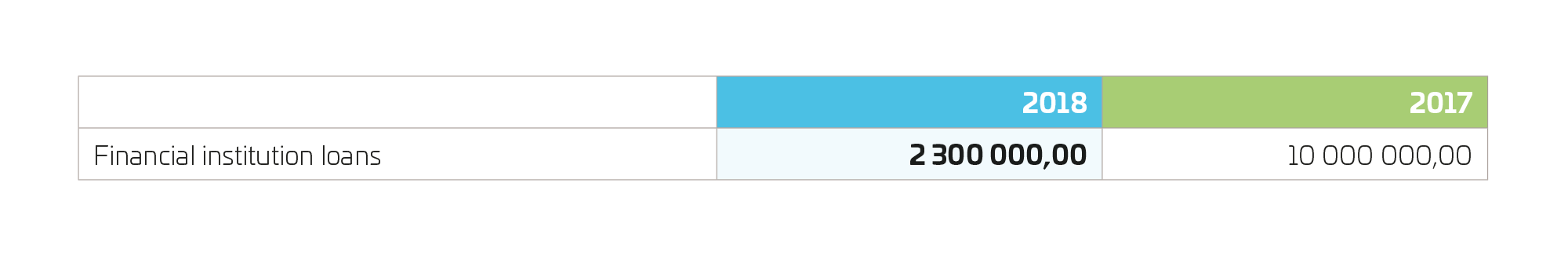

The company’s cash position continues to be good. Westenergy Oy Ab has done a complete revision of its methods of financing in 2017. The new funding programme of MEUR 66 was concluded with Handelsbanken. The funding programme includes a loan of MEUR 60 that was drawn down in 2017. In addition, a tranche of MEUR 6 was agreed upon and drawn down in 2018. The company has hedged nearly 100 per cent of its non-current liabilities with financial instruments against adverse developments in the financial markets in order to reduce the fluctuations in its financial results as well as its financial risks.

Westenergy provides strong support to development projects and dissertations on circular economy. The company has requested students to conduct final projects concerning these topics, for instance. Together with the University of Vaasa, the company has participated in the SHARE project – Industry sharing platform for boosting transition towards circular economy, organised by VTT Technical Research Centre of Finland. SHARE research consortium consists of VTT Technical Research Centre of Finland, University of Vaasa, Westenergy, HSY, Abloy, Roima and Sharetribe. Last year, three final projects were conducted on the topic. The first study analysed the economic importance of utilisation of slag while the second one studied how the amendments to the procurement and waste acts have affected Westenergy’s operations. The third final project created an analytical description of the closed material flows between the urban food production and waste-based energy production. The company has also participated actively in the development of local circular economy together with the municipality of Mustasaari, Vaasanseudun Kehitys Oy and Ab Stormossen Oy.

Westenergy has continued to survey an investment in a flue gas scrubber. The investment helps Westenergy Oy Ab comply with the stricter environmental standards. The European Union will make a decision on the Waste Incineration BREF, which is highly likely to lead to stricter emission regulations. In addition, the investment helps increase the capacity of district heat production by approximately 20 %. This further increases the role of Westenergy in the district heat production for Vaasa region. The tendering of the procurement was carried out in the end of 2018 and the actual supply agreement was concluded in February 2019. The goal is to install and introduce the scrubber already in 2019.

Westenergy Oy Ab was issued a new environmental license in 2017 but it has appealed against the decision. The company can continue to operate in accordance with the new license despise the appeal. The new environmental license has updated the plant capacity to reflect the reality and given a permission to invest in a flue gas scrubber.

Westenergy Oy Ab is committed to follow the quality, environmental, and occupational health and safety policies that the company has defined. Through certified systems, Westenergy Oy Ab aims to improve the overall quality and cost-effectiveness of its operations. An occupational health and safety system is used to manage known risks, maintain the health and working ability of employees and improve the occupational safety and occupational healthcare. Westenergy Oy Ab aims at managing environmental risks with actions and programmes defined in the environmental system. Westenergy Oy Ab reports new developments concerning the quality, environment and occupational health and safety to interest groups primarily in the form of an annual report. Westenergy’s management system, which complies with the standards of quality (ISO 9001:2015), environment (ISO 14001:2015) and new occupational health and safety (ISO 45001:2018), has been evaluated by an independent external evaluator in 2018. Westenergy is one of the first businesses in Finland to have its operational system certified in accordance with the new occupational health and safety standard (ISO 45001:2018).

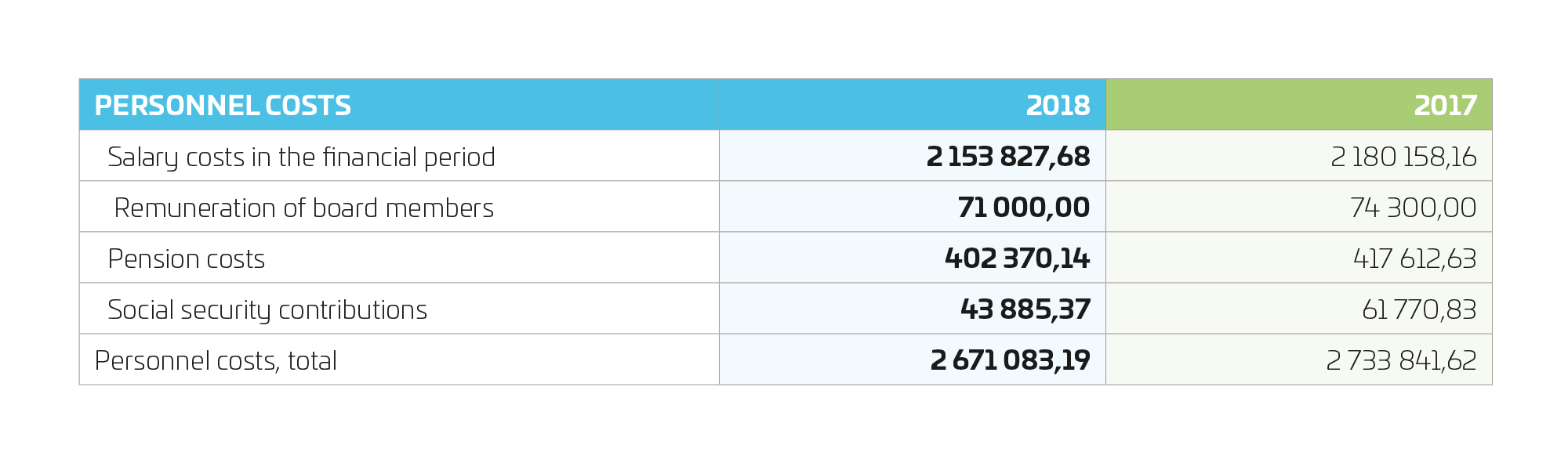

The company employed 30 people in the beginning of the financial period and 32 people in the end of the financial period. The average number of employees during the year was 36. The salaries and remuneration paid in 2018 totalled EUR 2,224,828. The following table includes some key figures related to the personnel.

| Year |

2018 |

2017 |

2016 |

2015 |

2014 |

| Number of employees, 1 Jan |

30 |

34 |

31 |

32 |

31 |

| Number of employees, 31 Dec |

32 |

32 |

34 |

30 |

34 |

| Average number of employees |

36 |

37 |

35 |

34 |

32 |

| Salaries and remunerations, MEUR |

2.22 |

2.25 |

2.16 |

2.04 |

2.03 |

| Absences due to illness, % of total working time (* |

2.11 |

2.98 |

3.54 |

3.18 |

3.12 |

| Number of accidents at work |

0 |

0 |

0 |

4 |

9 |

| *) Including sick leaves, absences due to illness of a child and absences due to accidents during work and leisure time |

In the past operating period, the Board of Directors consisted of Heikki Halla-aho (Chairman), Paavo Eloniemi (Vice-Chairman), Håkan Anttila, Paavo Hankonen, Jouko Huumarkangas, Ari Perälä, Harri Virtanen and Gunbritt Tallbäck (regular members). Håkan Anttila, a long-standing member of the board, passed away on 7 March 2018 and Ragnvald Blomfeldt was appointed to replace him as a regular member of the Board. The Board met seven times in total during the past financial period. Olli Alhoniemi has acted as the Managing Director of Westenergy. The company’s regular auditor was the CPA firm Ernst & Young Oy with Kjell Berts, CPA, acting as the principal auditor.

Early in 2016, Westenergy Oy Ab was sued for damages in the district court. The case was completed in the end of 2018. The district court issued an interim order dismissing the case in its entirety and ordering the suitor to pay for Westenergy’s legal expenses. The suitor has not appealed against the interim order or requested an extension of the appeal period.

Westenergy Oy Ab is negotiating with Loimi-Hämeen Jätehuolto Oy about ownership arrangements that would make Loimi-Hämeen Jätehuolto Oy an important shareholder of the company. Westenergy is also negotiating with the current shareholders about the changes in shareholdings. The negotiations are to be concluded by the end of 2019. The objective of the ownership arrangements is to strengthen the ownership base of Westenergy Oy Ab, which would guarantee a sufficient waste supply until a distant future and enable Westenergy to provide cost-effective services to its shareholders. Until now, the current shareholders of Westenergy have acquired non-recyclable waste for energy production also outside their own operating areas through contractual arrangements.

There have been no significant events after the end of the financial period.

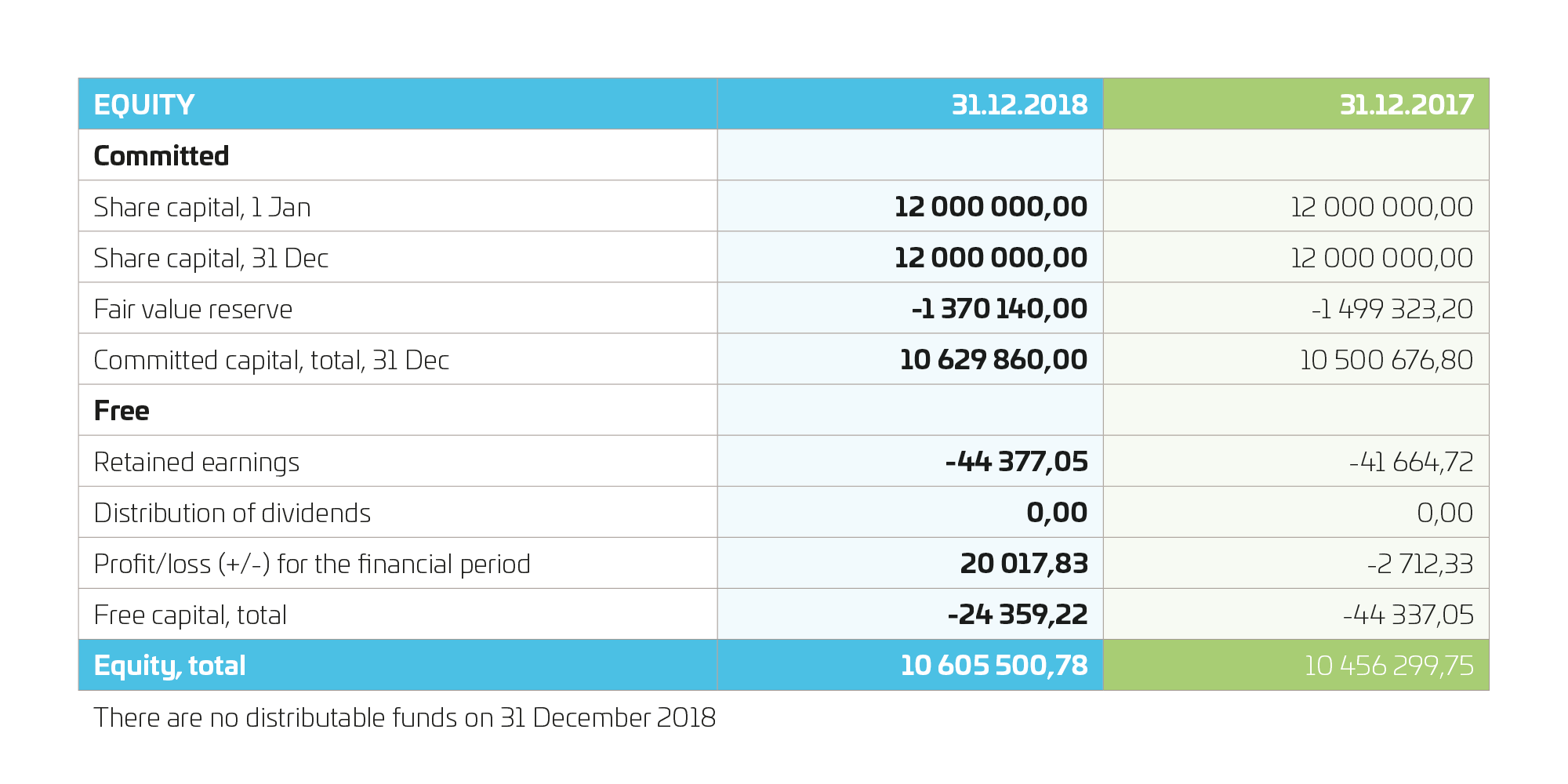

The company’s registered share capital was EUR 12,000,000 in the end of the financial period. The company has 12,000,000 shares. The redemption clause set in the articles of association is applied on the shares, according to which other shareholders have the primary right to redeem shares and the company itself has the secondary right if the shares are to be transferred to a third party.

Because of the absorption principle, it is not appropriate to compare the key figures to profit-making companies when analysing Westenergy’s operations, financial position and results.

In compliance with Section 3 of the articles of association, the company does not distribute dividends. The Board of Directors proposes that the net profit for the period of EUR 20,017.83 be transferred to the profit and loss account as the company’s equity.

Vaasa 11 April 2019

Westenergy Oy Ab, Company Board